The mortgage guarantee scheme announced at Budget 2021; will help to increase the supply of 5% deposit mortgages for credit-worthy households by supporting lenders to offer these products through a government backed guarantee.

The scheme follows on from the successful 2013 Help to Buy: Mortgage Guarantee Scheme, which helped to restore the low deposit mortgage market after the financial crisis, giving those who could afford mortgage repayments but not the larger deposits the chance to buy a new or bigger home.

From scheme launch, you can access more information on how to apply for a 5% deposit mortgage by contacting a mortgage broker or lender participating under the scheme.

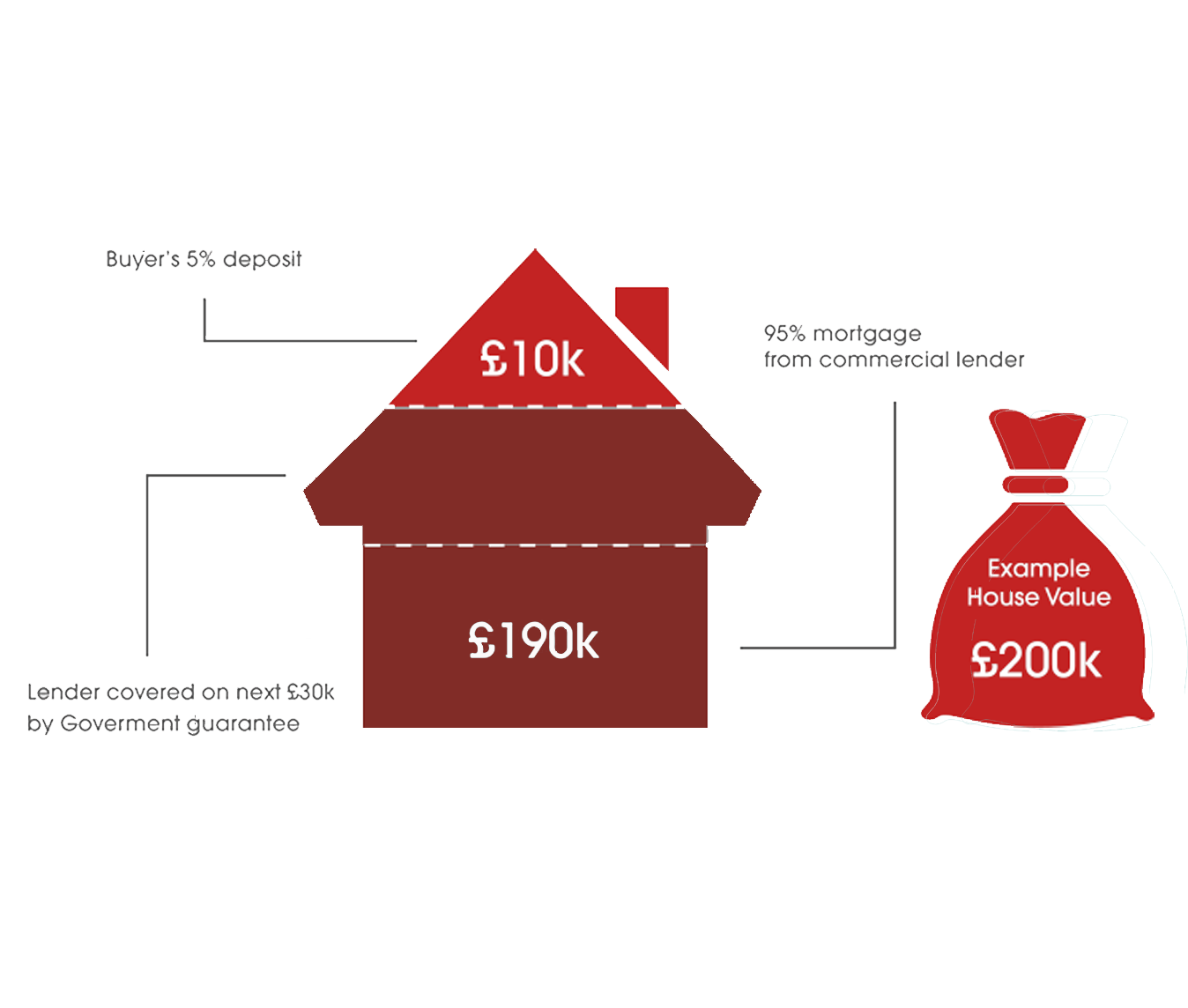

The mortgage guarantee scheme offers lenders the option to purchase a guarantee on mortgages where a borrower has a deposit of only 5%.

The guarantee compensates mortgage lenders for a portion of net losses suffered in the event of repossession. The guarantee applies down to 80% of the purchase value of the guaranteed property covering 95% of these net losses. The lender therefore retains a 5% risk in the portion of losses covered by the guarantee. This ensures that the lender retains some risk in every loan they originate.

The government is committed to making the aspiration of home ownership a reality for as many households as possible. The government want current and future generations to experience the benefits of owning their own home, in the same way as their parents and grandparents. The effects of COVID-19 have left lenders reluctant to independently offer 95% Loan-To-Value mortgage products, with only 8 products available nationwide in January 2021, compared to 386 products available in December 2019, meaning some creditworthy households cannot get a mortgage. Increasing the availability of 95% Loan-To-Value mortgages will help support First Time Buyers with smaller deposits take that all important first step onto the housing ladder. In addition, the scheme will support existing homeowners who wish to move, adding movement into the housing market and freeing up additional supply of affordable homes for First Time Buyers.

The mortgage guarantee scheme offers lenders the option to purchase a guarantee on mortgages which compensates the mortgage lenders for a portion of net losses suffered in the event of repossession. The borrowers who take out any mortgage product under the scheme will remain responsible for repayments in the same way as a normal mortgage. The scheme will continue to support responsible lending, meaning borrowers must continue to pass all the usual affordability tests set out by lenders, the FCA and Financial Policy Committee (FPC) in order to access a mortgage under the guarantee.

As with all mortgages, you should talk to your lender as soon as your circumstances change. If you fall into financial difficulties, you should speak to your lender. You may also wish to seek, independent advice as soon as possible. You are able to get free and impartial information and advice on money matters from the Money Advice Service. Their advice is available online, face-to-face, or by calling the Money Advice Service helpline on 0300 500 5000. You will not be treated differently by your lender if you have a mortgage which is included in the mortgage guarantee scheme. If the lender must repossess the property, you will be responsible for repaying any shortfall between the amount you owe to the lender and the amount recovered once the property is sold.

The mortgage guarantee scheme was set up to support households who cannot get a mortgage because of the reduced availability of 95% Loan-To-Value products caused by the COVID-19 pandemic. The mortgage guarantee scheme also helps existing homeowners who are looking to move and require a 95% Loan-To-Value mortgage. It is available across the UK on properties with a purchase price of £600,000 or less, where a borrower has a deposit of 5%. The Help to Buy: Equity Loan scheme is available to all those who aspire to own a new build home, but struggle to access or afford the repayments on a low deposit mortgage. Under this scheme the government provides an equity loan worth up to 20 per cent of the value of a new build home, interest free for the first 5 years. The equity loan must be paid back to the government on sale, or when the mortgage is repaid. There are several eligibility criteria set out under both sets of scheme rules, which are designed to ensure that it supports the government’s objectives. But in addition to these, all borrowers will need to pass the lender’s normal lending criteria, including their credit and affordability checks.

Help to Buy is a government backed initiative to help both first time buyers and existing home owners to buy a first home or to move up the property ladder.

A mortgage supported by the Help to Buy mortgage guarantee scheme works in exactly the same way as any other mortgage except that under the scheme the Government offers lenders the option to purchase a guarantee on mortgage loans. For more information please download the Guide.

Sell your property to Essential Estates Ltd today, we investigate the market trends specific to your property location and provide a genuine, realistic valuation. We will consider acquisition of a variety of residential and commercial property types within the Yorkshire and Lincolnshire regions including; houses, flats and apartments, retail units, offices, light manufacturing premises, factories and those buildings that require renovation or redevelopment.