We are Experts in Property Acquisition. If you are thinking about selling your property and want to get cash in the bank this week hassle free - talk to us.

The Essential Estates has a proven track record in successful acquisition and development of land and property in a variety of markets ranging from commercial, industrial, residential through to farmland.

We specialise in land development & property aquisition, building anything from quaint cul-de-sacs to major developments of 500+ homes.

We are part of the Essential Group of companies well known for the Five Star Coastal Holiday Village - The Bay Filey.

The development has been an active build since opening as a Holiday Park in 2007 with over 500 homes built and sold as second homes for private use and holiday lettings and is testament to the knowlege and quality of our services built over the last three decades.

We build picture perfect developments with the focus being on stylish quality homes with attractive landscaping in prominent residential locations which have great access to transport links and local schooling.

We specialise in the purchase and sale of land with development potential and work across the UK with our partners and clients to ensure smooth transaction process that instils confidence. We are cash buyers and can complete within 7 days.

If you are thinking about selling your property and want to get the best price in a hassle free process talk to us. We will consider acquisition of a variety of residential and commercial property types including; houses, flats and apartments, retail units, offices, light manufacturing premises, factories and buildings that require renovation or redevelopment.

If you are looking to realise the equity in your property and still want to live in your home talk to Essential Estates to find out how. We are proven providers of home reversion plans and regulated tenancy agreements.

Everything about the house and the development was just perfect.

James & Elizabeth / Harthill Close

Find an ideal place in the world for you and your family.

Our new homes come with 10 year structural warranty and 2 years on fixtures and fittings.

Essential Estates are part of the Essential Group of companies well known for the 5 star Coastal Holiday Village 'The Bay Filey'. The development had been an active build since opening as a holiday park in 2007 with over 500 homes built and sold.

From quaint cul-de-sacs to major developments of 500+ homes - Take a look at our work.

However you live your life, there's an Essential home to suit you, from stylish apartments to detached family homes.

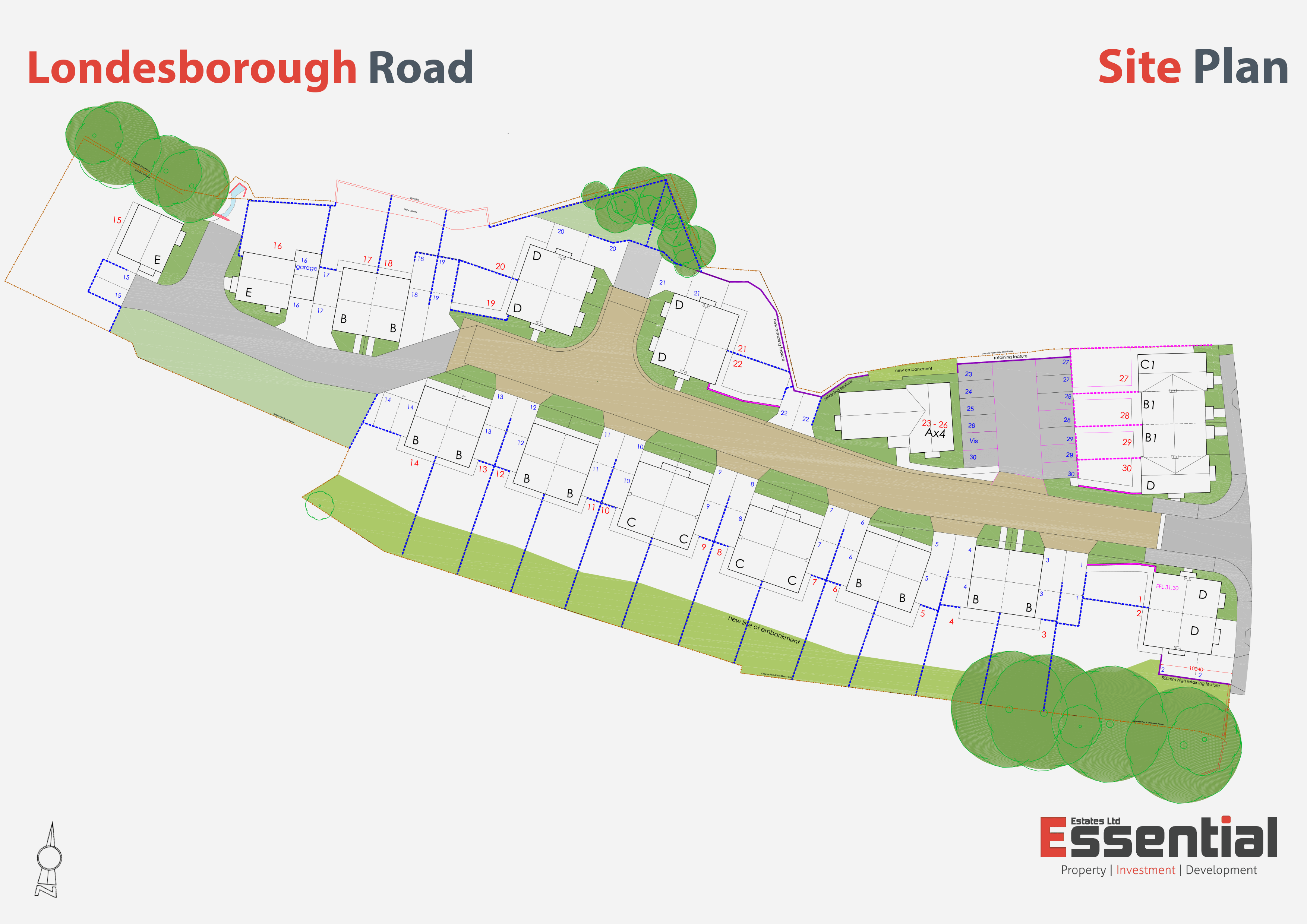

A new development located on Londesborough Road, Market Weighton. The development features a selection of 2 & 3 bedroom homes with prices starting from £215,000.

Hear what our customers are saying....

Having truly settled into our new home now we want to share how delighted we are with the property. We have lived in new builds before and encountered horrendous issues with snags and errors, but not in the case of Essential.

We are also still living on a building site, and have been impressed with the consideration; politeness and helpfulness of the team.

We are really pleased with the property and do intend this to be the last place we live! We would recommend Essential to anyone looking to buy a property. Thank you so much.

Colin & Angela Wood

I want to express my sincere gratitude for your patience, flexibility, and prompt response to my emails. As you were aware, the conveyancing process of my property sale was particularly challenging. I am truly grateful that you and Essential Homes were willing to wait for me. The journey with Essential Homes has been stress-free, simple and enjoyable.

I am thoroughly impressed with the quality of the build and extremely satisfied with the end result. The tiling and grout work is immaculate, and I am awestruck by the stunning appearance of the tiles. I find myself admiring the kitchen tiles and bathroom tiles frequently. Thank you so much. I am so happy.

Christopher Koay

The house is sublime! Love it. Thank you for sticking with us, it was a long purchase. This is our final ever move so it needed to be perfect for us and it is just that!

There is no comparison to our previous new build home which was from one of the leading builders, our new house is in a totally different class. If I may say, without sounding insulting, your company, in my opinion will be a thorn in the bigger boys side before long.

We wish you and your team/company all the best, we hope you'll return to build in Leven in the future!

Richard Scott

I have recently purchased my first home built by Essential Estates, literally from start to finish the team have been fantastic and made the whole process feel easy. Starting with the initial viewing both Patrick and Richard where on hand and made me feel really welcome, explained the layout of the plots, time scales etc.

Upon the first viewing it was clear that the houses had been built to a high standard with great finishes.From purchasing to the completion the team were fantastic, always on hand to answer any questions, or in my case carry out a couple of minor jobs which the guys helped me out with no problem. When we completed, Patrick made sure he was there and genuinely looked as happy for me as I was getting my first house. I wouldn’t hesitate to recommend Essential Estates 10/10.

Ian Gedney